Ah, the Annual Percentage Yield (APY)—it sounds so official, doesn’t it? Like something you’d hear during a late-night infomercial on investment hacks that promises to multiply your savings. But before you let your mind wander into the world of get-rich-quick schemes, let’s break down APY so that you, the investor, can understand exactly how much your money is really growing (or not) without getting caught up in the jargon.

So, What Exactly Is APY?

APY is a fancy way of saying “how much interest you’re going to earn on an investment or savings account over a year, assuming you don’t touch it.” It factors in the effect of compounding interest, which means that instead of just earning interest on your initial deposit, you’re also earning interest on the interest you’ve already earned. Think of it like interest stacking upon itself—a money snowball that gets bigger and bigger.

Unlike the simple interest model that only calculates interest on the original principal, APY takes compounding into account, so it gives you a more accurate picture of what your return will actually look like over the course of a year. That’s why it’s a much more reliable metric when you’re comparing different investment opportunities or savings accounts.

In other words, APY gives you the “real” return on your investment, taking into consideration how often your interest is compounded (whether it’s daily, monthly, quarterly, etc.).

The Math Behind the Magic

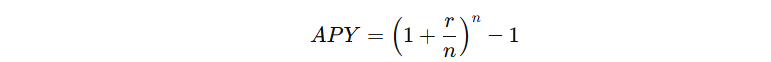

Alright, I know what you’re thinking: “Math? Really? I came here to avoid the boring stuff.” But don’t worry—this is just a quick little refresher on the formula for APY. You don’t need to memorize it, but just so you know, the magic happens with this formula:

Where:

- r = the annual interest rate (as a decimal, so 5% = 0.05)

- n = the number of times interest is compounded per year (daily = 365, monthly = 12, etc.)

For example, if you have an interest rate of 5% compounded monthly, the formula would give you an APY of about 5.12%, not just the 5% you might have expected. The more frequently the interest is compounded, the higher the APY will be, even if the interest rate stays the same.

Why Should You Care About APY?

As an investor, you’re looking for ways to make your money work harder. The last thing you want is to be fooled by a high-interest rate that doesn’t actually deliver much return because it’s not compounded often enough. Here’s where APY comes in handy—it captures the true value of your investment, including the power of compounding.

But wait—there’s more! Here’s why you should care:

- Better Comparison Tool

When you’re shopping around for a savings account, CD, or bond, APY is your best friend. It tells you exactly how much you’re going to earn, taking compounding into account. If one account has a 4% interest rate compounded monthly, and another has a 4.5% rate compounded quarterly, the APY is going to tell you which one is actually going to yield more over the course of the year. - The Magic of Compounding

We all love the sound of our money growing on its own, right? Well, the compounding effect means your interest gets reinvested into the account and starts earning its own interest. Over time, this can lead to some seriously impressive gains—even if you’re only starting with a modest amount. So, knowing the APY gives you a better idea of how much your money could grow without you having to lift a finger. - Saves You from Getting Tricked

You’ll often see banks or other financial institutions touting attractive interest rates. But without understanding how those rates are compounded, you might end up disappointed when the results don’t match the flashy numbers. APY ensures that you’re not getting swept away by the marketing buzzwords and can make an informed decision based on how much your investment will really earn.

APY vs. APR: What’s the Difference?

While APY gives you a true reflection of your earnings (taking into account compounding), APR (Annual Percentage Rate) is different. APR is used for loans and credit and doesn’t factor in compounding—it’s simply the interest rate applied to your loan balance. For example, a credit card might advertise an APR of 18%, but that doesn’t mean you’re going to pay 18% more every year. That APR is the annualized rate, but the interest can actually compound monthly, making your real cost higher.

In short, APY is about your earnings, while APR is about what you owe. It’s a simple distinction, but one that matters when you’re making financial decisions.

APY in the Real World: How It Affects You

So now you’re probably wondering, how do I use this knowledge? Should I be looking at APY for all my investments? The answer depends on what you’re investing in. Let’s take a look at a couple of real-world scenarios:

- Savings Accounts and CDs

If you’re putting your cash in a high-yield savings account or a Certificate of Deposit (CD), APY is essential. Here, you want to know exactly how much interest your money will earn without you doing much of anything (other than keeping it in the account). The more often interest compounds, the better your return will be—especially over long periods of time. For example, a 1% APY compounded daily is better than a 1% APY compounded yearly, even though the stated rates are the same. - Bonds and Other Fixed Income Investments

While bonds don’t typically use APY, it’s still good to understand the difference between interest rates and yield. With bonds, the yield you get will reflect the interest rate, the purchase price, and the time left until maturity. It’s like the APY of fixed-income products—but it’s a little more complicated. Bond yields give you a better idea of how much you can expect to earn based on the bond’s current price, rather than its coupon rate alone. - Retirement Accounts (Like IRAs or 401(k)s)

In the world of retirement, you don’t always see APY plastered everywhere, but the concept still applies. The idea is that compounding growth (in a 401(k), for example) over many years can result in some serious growth. While APY isn’t always the metric you’ll see, understanding compounding and growth potential will help you build that sweet retirement nest egg.

Final Thoughts: Understanding APY to Make Better Decisions

When you’re in the market for a savings account, bond, or other fixed-income product, understanding APY is crucial to ensure you’re getting the best bang for your buck. It helps you compare returns across various products, gives you insight into the power of compounding, and ensures you don’t fall for those deceptive interest rate ads.

It might sound boring at first, but trust me—understanding APY will give you the confidence to make smarter decisions with your cash. After all, the more you know, the better your chances of making your money grow—without falling for the marketing fluff. So, next time you see that shiny interest rate on a savings account, check the APY, and see what it’s really going to do for you. Your future self will thank you.