Annual Percentage Rate (APR): The Real Cost of Borrowing, Wrapped Up in One Percentage

Ah, APR—those three little letters you’ll often see when you take out a loan, apply for a credit card, or dive into any form of borrowing. But what does APR actually mean? And more importantly, why should investors care? After all, we’re usually more focused on making money than paying it, right?

Well, APR is a critical number to understand, especially for those of us who are navigating the world of borrowing, credit, and even investment opportunities. So let’s take a deep dive into what APR is, how it affects your wallet (or your portfolio), and why you should keep a sharp eye on it.

What is APR?

At its core, APR stands for Annual Percentage Rate, and it’s a measure of the cost of borrowing money over the course of a year, expressed as a percentage. Unlike the interest rate, which only includes the interest charged on the loan, APR includes both the interest and any other fees that are part of the loan (like application fees, closing costs, or service charges).

Essentially, it’s a way to give you the big picture of what borrowing really costs you. Think of it as a better-than-average blind date. You can’t judge the whole thing based on just the first impression (interest rate); you need to factor in the extra costs (fees) that might show up after a few dates.

For example, if you take out a loan for $10,000 and the APR is 10%, your total cost for borrowing that $10,000 over the course of the year (including interest and fees) will be $1,000. This means you’ll end up paying $11,000 total to settle the debt—not bad, but also not the most exciting return on your money!

Why Should Investors Care About APR?

You might think APR only matters to people who are borrowing money, but here’s why investors should pay attention as well:

1. Evaluating Debt Financing Options

If you’re investing in companies that rely heavily on debt for financing, understanding how they manage their APR can give you deeper insight into their financial health. Companies with high APR loans are paying more in interest and fees, which can eat into their profits. This could lead to lower earnings or even higher risk—and as investors, we like to minimize risk and maximize returns, right?

Investor Takeaway: Keep an eye on APRs for companies in your portfolio or those you’re looking to invest in. A company with a high APR might be paying a lot more to service its debt, which could ultimately hurt your bottom line. Debt isn’t always bad, but expensive debt can be a red flag.

2. Understanding the Cost of Borrowing for Your Own Investments

Let’s say you’re the one borrowing money to finance a new investment—like buying property, margin trading, or even taking out a business loan to fuel growth. The APR on that loan will directly impact the cost of your investment. A high APR means you’ll have to work harder to generate returns that cover your loan payments.

For instance, if you’re considering using leverage to boost your investment returns (borrowed money to increase your buying power), a high APR might make that leverage a lot less attractive. If your investment return can’t beat the APR, you could end up losing money.

Investor Takeaway: Borrow wisely, and always make sure your returns are greater than the APR you’re paying. Otherwise, you’re essentially paying to lose—not the kind of investing we’re going for.

3. Evaluating Credit Card Offers

As an investor, you may also find yourself using a credit card for convenience or rewards. But here’s the thing: If you don’t pay off that balance in full, you’re stuck with the APR on the outstanding balance. And trust me, those APRs on credit cards can be brutal—often upwards of 20%.

Now, imagine you’re running a business or even just personally financing some investment projects with a credit card—if you’re not careful, you could end up paying more in interest than you earn in returns.

Investor Takeaway: If you’re using credit cards for anything beyond “purchasing a coffee on the go,” you’d better know that APR inside and out. The cost of credit card debt can spiral quickly, and unless your returns are outpacing that APR, it could drain your funds faster than you can say “compound interest.”

4. Comparing Loan Products

Whether you’re looking at student loans, mortgages, or even business loans, understanding APR is a must for comparison shopping. Lenders love to advertise super-low interest rates to get your attention, but don’t get too starry-eyed! Sometimes, what they’re not telling you is the extra fees attached, which can make a seemingly cheap loan cost a lot more.

Think of it like buying a new car: the sticker price might look reasonable, but then you realize you need to pay for “extras” like the sunroof, leather seats, and that magic paint that keeps your car from rusting. APR gives you the true cost of borrowing money, so you’re not caught off guard later.

Investor Takeaway: Whether it’s financing your own investments or evaluating company debt, always use APR as the benchmark. Don’t be seduced by a low interest rate without looking at the whole picture.

How to Calculate APR (In Case You’re Curious)

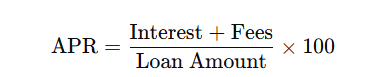

Here’s a quick breakdown of how APR is calculated (because we know you love a good formula)

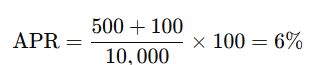

For example, if you borrow $10,000, pay $500 in interest, and incur $100 in fees, the APR would be:

It’s that simple. The key takeaway? APR is your true cost of borrowing—so don’t just look at the interest rate. Think of APR as your financial “gauge”, showing you the full cost of taking on debt.

The Downside of APR (For Your Wallet)

As much as we like to talk about APR in glowing terms, the reality is, it can hurt if you’re on the wrong end of it. High APRs on loans or credit cards can quickly compound and eat into your earnings or investment potential. This is why it’s crucial to shop around and find the best APR when borrowing money. No one wants to pay a ton of interest when they could be putting that money toward growing their wealth.

Investor Takeaway: High APR? High risk. Whether you’re an individual investor borrowing money or evaluating companies with high APR debt, proceed with caution. Debt can work wonders if managed right, but if you’re stuck with high APRs, it could be like trying to walk through quicksand—slow and costly.

The Bottom Line: APR is More Than Just a Number

As an investor, understanding APR is about more than just saving a few bucks on a loan or credit card. It’s about understanding the true cost of borrowing, whether you’re borrowing for yourself or analyzing the debt of companies in your portfolio. A high APR can turn an investment from a potential goldmine to a costly mistake.

So, before you sign on the dotted line, take a moment to check the APR. It’s the financial equivalent of checking the ingredients list before buying a snack—you want to know exactly what you’re getting into.

Happy investing, and don’t forget to mind that APR—it could make all the difference in the long run!