When you’re deep in the weeds of investing, metrics like Asset Turnover Ratio might seem like jargon only accountants love. But don’t be fooled—this little number can reveal a lot about how well a company is using its assets to generate sales and, ultimately, profits. It’s the financial equivalent of seeing how fast someone can run a mile—you want a fast time, right? Well, for companies, you want a high asset turnover ratio.

Let’s dig into what this ratio means, why it matters, and how you, as an investor, can use it to spot efficient companies that are making the most of their assets.

What is Asset Turnover Ratio?

In the simplest terms, Asset Turnover Ratio measures how efficiently a company uses its assets to generate revenue. Specifically, it calculates the amount of sales a company generates for every dollar invested in assets.

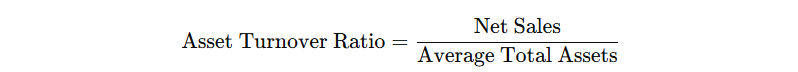

Here’s the formula:

This ratio tells you how much sales (or revenue) a company can squeeze out of its assets. Think of it as how well a company turns its assets into cash—but without needing to actually sell off those assets. The higher the ratio, the better the company is at using its assets to drive sales.

Why Should Investors Care About Asset Turnover?

As an investor, your goal is to find companies that maximize efficiency, right? Well, the asset turnover ratio is a clue to how well they’re doing that. Here’s why it matters:

1. Efficiency Indicator

The asset turnover ratio is an important efficiency metric. High turnover means that the company is able to use its assets effectively to generate sales. It’s a bit like running a business at full throttle—every dollar of assets is working hard to bring in revenue.

Investor Takeaway: If a company has a high asset turnover ratio, they’re likely managing their assets well, and that’s good news for you as an investor. A company that can produce more revenue with less investment in assets could be an attractive option.

2. Comparing Companies

You can use the asset turnover ratio to compare companies in the same industry. Let’s say you’re deciding between two companies in the same sector—company A has a high ratio, and company B has a low one. Company A is using its assets more efficiently, which could indicate better management, a leaner operation, or a more agile business model.

Investor Takeaway: This ratio helps you compare firms on efficiency, which is especially valuable in industries with high capital requirements (think manufacturing or retail). If two companies are in the same industry, but one has a significantly higher asset turnover, you might want to lean toward that one for your portfolio.

3. Industry Insight

Some industries naturally have a lower asset turnover (think heavy industries like utilities, oil & gas, or real estate), while others have higher asset turnover (think tech, consumer goods, or software). So, understanding what’s normal for a particular industry helps you evaluate a company’s performance in context.

Investor Takeaway: Industry context is crucial. A low asset turnover in one sector might not be a red flag, but in another sector, it could be a sign that the company isn’t managing its resources as effectively as its peers.

What’s a Good Asset Turnover Ratio?

Now, here’s where it gets interesting. There’s no magic number for “good” asset turnover because it varies by industry. A high ratio for a retail store is vastly different from a manufacturing plant. Here’s a quick guide:

- Retailers (like Walmart): A high asset turnover ratio, often between 2-4. Why? Because retailers rely heavily on sales volume, and they need to make the most of their assets (like inventory and store space).

- Technology Companies (like Apple): Often have a lower asset turnover ratio, sometimes around 1 or less. Why? Because tech firms rely on intellectual property and specialized assets (rather than physical ones) to generate sales.

- Manufacturers: These businesses tend to have lower asset turnover ratios because they invest heavily in equipment and facilities. A ratio around 0.5 to 1 might be typical.

So, don’t panic if a company you’re eyeing has a low ratio—it’s all about understanding the context.

How Does Asset Turnover Affect Your Investment?

The Asset Turnover Ratio can tell you a lot about how efficiently a company is utilizing its capital, but as an investor, you want to look at it alongside other ratios and performance indicators. Here’s how this number can affect your investment decisions:

1. Growth Potential

If a company has a high asset turnover ratio, it could be a sign that they are growing quickly without needing to invest huge amounts in new assets. That’s attractive if you’re looking for growth opportunities with lower capital intensity.

Investor Takeaway: A company with a strong asset turnover ratio might be growing faster than its competitors and could represent a good investment opportunity, particularly in industries where high growth and capital efficiency are prized.

2. Sustainability of Profits

A high asset turnover ratio might also signal that the company’s profits are more sustainable. Efficient use of assets suggests that they’re not depending too much on borrowing or large capital expenditures to generate revenue. This can be a good indicator that the company is on stable financial ground.

Investor Takeaway: Keep an eye on companies with solid asset turnover ratios—they might be more sustainable in the long term, and their profits are likely to be built on solid, reliable growth rather than risky bets.

3. Warning Signs

But be careful—if a company’s asset turnover is too high, it could signal potential issues. For example, if a firm’s ratio skyrockets because they’re aggressively pushing inventory or cutting corners on asset maintenance, that could be a sign they’re over-leveraging or cutting quality. Similarly, a company with a very low asset turnover might be underutilizing its assets, which could signal inefficiency or overinvestment in capital.

Investor Takeaway: As with anything, balance is key. You don’t want a company that’s underusing assets (low turnover), but you also don’t want one that’s using them recklessly (too high turnover).

How to Calculate Asset Turnover Ratio

If you’re feeling adventurous, you can easily calculate the asset turnover ratio of a company yourself. Here’s the step-by-step:

- Find the net sales: This is usually listed on the income statement.

- Find the average total assets: Add the assets from the beginning and end of the period (usually a year) and divide by 2. You can find this in the balance sheet.

- Plug the numbers into the formula: Divide net sales by average total assets.

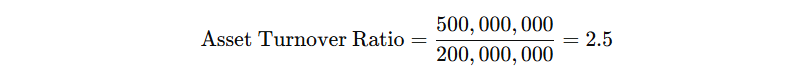

For example, if Company X has $500 million in sales and $200 million in average assets, the formula would look like this:

This means Company X generates $2.50 in sales for every $1 of assets it has. If that’s higher than its industry average, congratulations—you’ve just found a potentially efficient company!

Conclusion: The Power of Efficiency

When you’re investing, you want companies that aren’t just growing—you want companies that are growing smartly. The Asset Turnover Ratio is your clue that a company is getting the most out of its assets, without being wasteful or inefficient. While a high ratio often signals strong management and operational efficiency, it’s always important to consider the broader context—industry norms and the company’s unique strategy.

Next time you’re looking at a company’s financials, check out the asset turnover ratio. A strong number could be a sign that the company is getting the most bang for its buck, making it an attractive candidate for your investment portfolio. So go ahead—add this metric to your investing toolkit. It’s like knowing how fast a car can go; the faster the better, but only if it’s driving on the right road!