If you’re an investor (or aspiring to be one), you’ve probably heard the term “Annualized Rate of Return” (ARR) thrown around at some point. It sounds like one of those fancy terms that only financial wizards understand, right? Well, guess what? It’s not magic—it’s just math, and it’s pretty darn useful for making smart investment choices. If you’ve ever wondered how your year-over-year performance stacks up, or if you’ve ever had to compare different investments, this little metric is your best friend.

What Is the Annualized Rate of Return?

The Annualized Rate of Return is essentially a measure of how much an investment has grown or shrunk on average each year over a certain period of time. It helps investors to compare the profitability of different investments, especially when those investments span different time periods.

In simpler terms: It’s like looking at your investment growth and asking, “What would my returns have been per year if my investment performed at this same rate for the entire period?” Think of it as giving you a clear, apples-to-apples comparison between investments, even when those investments didn’t start and finish at the same time.

Why Should Investors Care About the ARR?

Let’s face it—most of us don’t have the luxury of spending every waking moment in front of a stock ticker. We’ve got things to do: family, friends, work, the occasional Netflix binge. So when you’re analyzing a portfolio or evaluating whether to buy or sell, you want to cut through the noise. That’s where the Annualized Rate of Return comes in. It makes the process simpler, less confusing, and, frankly, more enjoyable. Here’s why it should be on your radar:

- It Helps You Make Real Comparisons

- Picture this: You’re deciding between two investments. One’s been around for 5 years, and the other has only been going for 1 year. Without annualizing, comparing these two could be like comparing a tortoise to a rabbit—one has had years to work its magic, the other is just getting started. By annualizing the returns, you adjust for the time difference and get an apples-to-apples comparison. Suddenly, the rabbit doesn’t look so fast, does it?

- It Makes Predictions More Reliable

- No, it’s not a crystal ball. But annualized returns help you gauge the future potential of an investment based on its historical performance. Sure, past performance isn’t a guarantee of future results (you’re not going to keep winning at the same rate forever—sadly). But by annualizing, you at least get a predictable pattern you can use to make more informed decisions.

- It Helps You Plan for the Long-Term

- Whether you’re looking at your retirement fund, real estate investments, or even that crazy side business you started (and didn’t tell your friends about), annualized returns give you an idea of how much your money could grow year-over-year. It’s like getting a forecast of how much more pizza you’ll be able to buy each year, except with less cheese and more numbers.

How Do You Calculate the Annualized Rate of Return?

Alright, buckle up! Here’s the math part. Don’t worry, we’ll keep it simple.

1. The Formula for ARR:

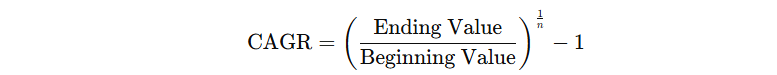

The most common way to calculate the Annualized Rate of Return is through the CAGR (Compound Annual Growth Rate) formula:

Where:

- Ending Value is the value of the investment at the end of the period

- Beginning Value is the value of the investment at the start of the period

- n is the number of years the investment was held

2. An Example to Make It Real:

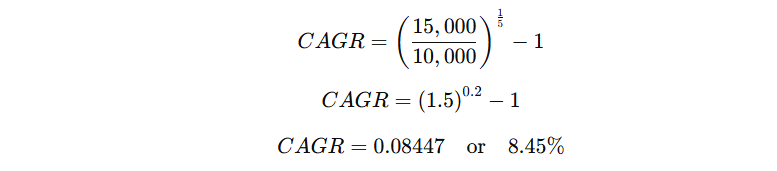

Let’s say you invested $10,000 in a stock 5 years ago, and it’s worth $15,000 today. Let’s calculate the annualized return over those 5 years.

- Ending Value: $15,000

- Beginning Value: $10,000

- n (number of years): 5

Using the formula:

So, your annualized return (or CAGR) over 5 years is 8.45%. That means, on average, your investment grew by 8.45% each year.

3. What if the Period Isn’t Years?

- If you’re not working with years—say you have quarterly data, or you’re looking at monthly returns—you can adjust the formula to match the time periods you’re using. Just remember to adjust the number of periods to match the frequency of your data (like 4 quarters per year or 12 months per year).

When Should You Use the ARR?

You might be asking, “When should I bother with this whole annualized thing?” Well, here are some cases where it’ll really come in handy:

- Comparing Different Investment Periods

- Maybe you’re looking at stocks and bonds, but one’s been holding steady for 20 years and the other is a newbie. By annualizing, you can get a clearer picture of which investment has delivered better performance over time, adjusting for different timeframes.

- When You Need a Benchmark

- Investors love benchmarks—mostly because it’s nice to know if you’re doing better than average. If you’re considering a new investment, you can annualize its performance and compare it to benchmarks like the S&P 500 or industry standards to see if it’s really worth your time.

- For Retirement Planning

- Whether you’re saving for retirement or just trying to grow your wealth for the long term, annualized returns give you an idea of how quickly your money could grow, compounding over time.

- To Understand Risk vs. Reward

- Investors love a good risk-reward ratio. If you know the annualized return of an investment, you can better assess whether it’s worth the risk you’re taking on. It’s like asking yourself, “Am I getting enough return to make those sleepless nights worth it?”

A Word of Caution: It’s Not All Sunshine and Rainbows

While the annualized rate of return is a great tool for understanding performance, it has its limitations.

- It Assumes Constant Growth: ARR assumes that the return will be the same every year. In reality, investments fluctuate. So, while ARR gives you a good snapshot, it’s not an exact science.

- It’s Based on Historical Data: Just like the classic line, “Past performance is no guarantee of future results”, ARR is based on what has happened, not what will happen. Don’t bet the farm on it.

Final Thoughts: Don’t Overlook This Little Number

The Annualized Rate of Return is like a magnifying glass that lets you see how your investments stack up over time. It smooths out the short-term bumps and gives you a clearer idea of where things might go in the future. Whether you’re looking at stocks, real estate, or even that new startup you’re considering investing in, knowing your ARR can help you make smarter decisions.

So, the next time you’re debating whether to hold or sell, or wondering how your portfolio is performing, just remember: the Annualized Rate of Return is your go-to metric for translating investment performance into something meaningful.

And hey, if nothing else, it’ll help you impress your friends at the next dinner party. You can casually drop, “Oh, my portfolio’s had a 9% annualized return over the last 5 years,” and watch as they nod knowingly, while secretly Googling the term.