You might have heard the term “annualize” thrown around in investment circles, especially when talking about returns. Maybe you thought, “Oh, that’s just some fancy finance term for making things sound complicated.” But guess what? It’s actually pretty simple and super useful for investors. And here’s why: understanding how to annualize can help you predict performance, compare investments, and ultimately make better decisions. Let’s break it down so you don’t need a financial dictionary to get it.

What Does It Mean to “Annualize”?

At its core, to annualize something means to take a number (usually a return) and convert it to an annual figure. It’s the magic of converting data from a smaller period of time (like a month or a quarter) into a full-year equivalent. It’s like when you see someone eat a pizza in under 10 minutes and you calculate how many pizzas they could eat in an entire year if they kept up that pace. That’s annualization in a nutshell.

For example, if you see a monthly return of 2%, you might want to know, “What would my return look like if I maintained that pace for a year?” By annualizing the return, you can make apples-to-apples comparisons between different investments, even if they’re on different timeframes.

Why Should Investors Care About Annualizing?

Now, you’re probably thinking, “Why should I bother annualizing? I’m here to make money, not to do math.” Fair enough, but here’s why you need this tool in your investor toolkit:

- Making Comparisons Easy

- Think about it. You’re comparing a real estate investment that gives you 5% monthly returns with a stock portfolio that delivers 1.5% monthly returns. They’re different investments, with different timeframes, so it’s hard to get a true sense of which one is better.

- Annualizing those returns helps you see what both could look like at the end of the year, making it easier to compare apples to apples. It’s like adjusting the volume on your speakers so you can hear everything at the same level. Much better!

- Predicting the Future (Sort of)

- Annualized returns can give you an idea of what your investment might look like over the long haul. Now, we all know past performance is no guarantee of future results (seriously, brokers probably have to say that 5,000 times a day). But still, by annualizing returns, you can get a good estimate of what the year could hold if everything stays the same. Wouldn’t you want to know if that pizza-eating record would hold up for 365 days?

- It’s like putting your financial future through a time machine: take today’s returns and project them into the future, then adjust as needed based on your risk tolerance and the market’s mood swings.

- Tuning Out the Noise

- The market moves up and down constantly. Short-term returns can be all over the place—just like your mood during tax season. By annualizing returns, you smooth out the volatility and get a clearer picture of your investment’s true potential.

- So when someone tells you “the market’s been up 1% today!” you’ll just smile and say, “Is that annualized? Because I’m not impressed unless I can see the big picture.”

How Do You Annualize?

Here’s where the math gets its moment in the spotlight. Don’t worry; we’ll keep it painless. There are a couple of ways to annualize depending on what you’re working with:

1. For Simple Periodic Returns

If you’ve got returns for a specific period—say a month or a quarter—you can annualize them by multiplying the return by the number of periods in a year. For example:

- If you get a 2% return in a month, to annualize it, you multiply 2% x 12 months (because there are 12 months in a year).

- 2% x 12 = 24% annualized return. Voilà! Simple, right?

2. For Compound Periodic Returns

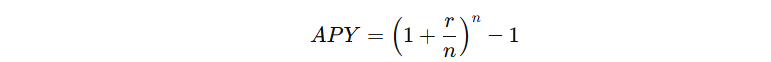

If your return isn’t simply additive (like compounding), you’ll need to get a bit more mathematical. You would use this formula:

Annualized Return = (1 + Periodic Return)^number of periods in a year – 1

For example, if you had a 1% return each month, and you’re compounding that monthly return over a year:

- (1 + 0.01)^12 – 1 = 0.1268 or about 12.68% annualized return.

This is more accurate because compounding means your returns are being reinvested each period, so they snowball rather than just adding on top of the original amount.

How Can Investors Use Annualized Returns?

So, we get it. You’re sold on the value of annualizing returns, but what can you do with this knowledge? Plenty.

- Track Your Progress: If you’re an investor working toward a specific goal, knowing your annualized return helps you gauge if you’re on track. Are you ahead of schedule? Are you falling short? Without annualizing, you’d be flying blind in a market that’s anything but predictable.

- Make Smarter Decisions: Comparing annualized returns lets you compare multiple investment opportunities with ease. Whether you’re looking at stocks, bonds, or even alternative investments, knowing the annualized return helps you assess risk and reward. You wouldn’t choose the guy who eats one pizza a year over the guy who eats 100. Similarly, in investments, you want the strategy that suits your risk appetite.

- Understand the Impact of Compounding: Annualizing returns is particularly helpful when you’re dealing with compound interest or returns that grow exponentially. It gives you an idea of how powerful compounding can be over time. It’s like taking a picture of your returns over time and realizing your money’s been multiplying like rabbits in a well-fertilized garden.

A Word of Caution: Don’t Over-Rely on Annualized Returns

Annualized returns are helpful, but let’s not pretend they’re all-knowing. They’re estimates based on the assumption that returns will continue at the same pace, which is, of course, a big assumption. The market is unpredictable, and past performance isn’t always a predictor of future results. If it were, we’d all be on a beach somewhere sipping margaritas with our perfectly timed investments.

So, use annualized returns as one tool in your investor toolbox, but don’t base your entire investment strategy on them. They give you an idea of where you’re headed, but you’ll still need to keep your eyes on the road.

Final Thoughts: More Than Just a Math Trick

While the concept of annualizing might seem like a simple math trick, it’s incredibly useful for making smarter investment decisions. It helps you cut through the short-term noise, predict the future (a little bit), and compare investments in a meaningful way.

So next time someone mentions “annualized return,” you can nod knowingly and think, “I got this. It’s just like pizza, but with money.”

Now, go ahead—calculate those returns and use the power of annualization to guide your way to investment success. Just remember to keep your expectations realistic, your strategy flexible, and your sense of humor intact. Because, let’s face it, even in the world of investing, we all need a little bit of fun and a lot less stress.