Let’s face it, investing is all about the numbers, and as investors, we live in a world where percentages are our best friends. We love seeing returns on our investments, watching our portfolios grow, and figuring out how much we can buy with those returns. But what happens when Uncle Sam comes knocking, looking to take a slice of your pie? Enter the After-Tax Real Rate of Return (ATR), the figure that helps you figure out how much of your investment returns are actually making it to your wallet after taxes and inflation.

So, how does this mystical number work, and why should you care? Let’s break it down, and we’ll even add a sprinkle of humor so that the taxman’s share doesn’t seem too painful.

What is After-Tax Real Rate of Return?

In simple terms, the After-Tax Real Rate of Return is the return you earn on an investment after accounting for both taxes and inflation. This figure gives you the most accurate picture of your actual purchasing power—the real money you can use—once the government takes its cut and inflation erodes some of your profits.

Here’s the breakdown:

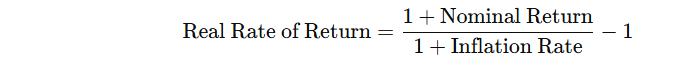

- Real Rate of Return: This is your return after inflation has been factored in, showing how much you’ve actually earned in terms of purchasing power.

- After-Tax Return: This is your return after the taxman takes his share.

- ATR: Combine these, and you get the after-tax real rate, the true return you’ve earned after both taxes and inflation.

Now, if this all sounds like a lot of math, don’t worry. Let’s dive deeper and see how it works in action.

Why Does After-Tax Real Rate of Return Matter?

As an investor, you want to know how much money you’re really making after taxes and inflation, not just what the headline figures say. A shiny 10% return on paper may sound great, but after taxes and inflation, you could be left with a lot less.

Let’s break it down with a simple example:

The Scenario:

You’ve invested $100,000 in a stock that gives you a nominal return of 10%. After one year, you have $110,000. Now, it sounds like a win, right? You made $10,000.

The Problem:

But here comes Uncle Sam, with his tax bill. Let’s say you’re in a 25% tax bracket. That means $2,500 of your $10,000 profit goes to taxes, leaving you with $7,500.

So, your after-tax return is 7.5%, not 10%.

The Inflation Factor:

But wait, there’s more! Inflation is eating away at the value of that $7,500. If inflation is running at 3%, the real value of your return has been reduced.

Using the real rate of return formula:

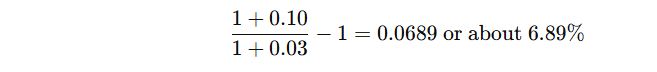

So, after plugging in the numbers:

Now, the after-tax real return is 6.89% instead of the initial 10%. And that’s what you’re really working with.

Why Should Investors Care About ATR?

Now that we’ve done the math, let’s talk about why this matters for you as an investor.

- True Return on Investment:

The After-Tax Real Rate of Return gives you a clearer picture of what you’re really earning. Think about it: if your portfolio is yielding 8% annually, but inflation is at 3% and taxes are taking another 25% chunk, your true return could be much lower than you thought. That can influence investment decisions, especially when you’re comparing different asset classes.- Investor Insight: Don’t just look at the headline nominal return. The real power of your portfolio is found after taxes and inflation. Focus on ATR to better gauge how your investments are really performing.

- Evaluating Investment Strategies:

Some investments, like municipal bonds, are tax-exempt, while others may be more tax-efficient, like index funds. Understanding your ATR can help you decide between options that maximize your after-tax returns.- Investor Insight: A bond offering a 6% return might sound good, but if it’s taxable, and your ATR after taxes is just 4%, you may want to consider tax-efficient options like municipal bonds or tax-deferred retirement accounts.

- Inflation-Adjusted Performance:

Inflation isn’t just a pesky number—it’s a silent investor killer. Over time, inflation erodes the value of money, and you might end up earning a decent return in nominal terms but actually losing purchasing power. The ATR helps you beat inflation by showing you how much your return is really worth in today’s dollars.- Investor Insight: Inflation can be sneaky. It’s not just the 3% you see today—it compounds over the years. Understanding ATR lets you keep your investments ahead of inflation’s slow creep, so your money doesn’t lose value over time.

How to Calculate After-Tax Real Rate of Return

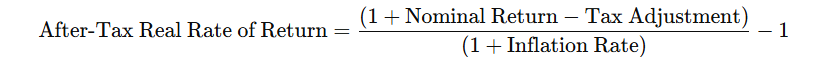

Ready to get your hands dirty? Here’s the formula you can use to calculate your After-Tax Real Rate of Return:

- Start with your nominal return (pre-tax return).

- Subtract your tax (tax rate × nominal return).

- Adjust for inflation using the formula we mentioned earlier.

The full formula looks like this:

You can plug in the numbers from your own investments to get a more accurate picture of your real return. This number helps you see if you’re really achieving your financial goals or if inflation and taxes are nibbling away at your profits.

The Takeaway: Keep It Real (Literally)

Investing is about making money, and as much as we’d like to believe those headline returns are everything, it’s the after-tax real rate of return that truly matters. It tells you how much you’re actually keeping after inflation and taxes, and it’s the figure you should really focus on when evaluating your portfolio’s true performance.

Remember, if you’re relying solely on nominal returns, you might be in for a rude awakening when you factor in the real-world impact of taxes and inflation. And hey, the next time Uncle Sam comes knocking, you’ll know exactly how much you’re really taking home.

So, while taxes and inflation are no one’s favorite topics, knowing how they affect your returns can make all the difference between a good investment and a great one. Stay informed, do the math, and keep your eyes on the after-tax real returns—because that’s what you’ll be spending in the end!